During the last major recession from 2007 to 2009, a little-known entrepreneur named Jeff Greene

made billions of dollars by buying credit default swaps on subprime mortgage-backed bonds as the housing bubble collapsed.

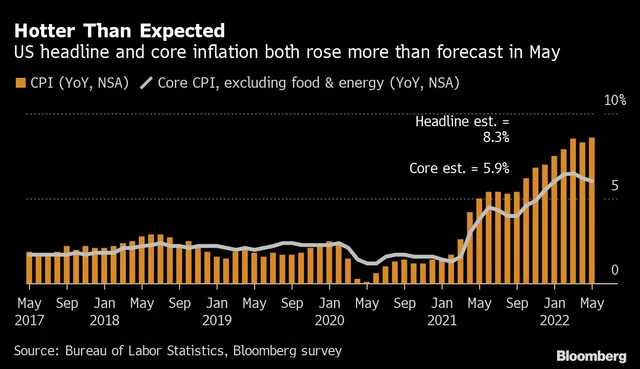

Now Greene, a Palm Beach-based real estate mogul with an estimated $5.1 billion fortune, thinks the economy is going through another bubble in assets ranging from crypto and SPACs to overvalued tech stocks and real estate. "We've been in an omnibubble, there's no question about it," Greene, 67, told Forbes in a phone call from his Hamptons estate, something he’s been saying for months now. "If you spend trillions and trillions of dollars in every advanced economy in the world and have coordinated fiscal and monetary stimulus, obviously you’re going to create bubbles and inflation."

Asked when he thinks a recession will hit, Greene guessed it might come in the first or second quarter of 2023. "Next spring [we'll] definitely be in a much slower economy,” he said. “If this recession really happens, you'll have all kinds of people stopping their construction projects and laying people off and [you’ll] start to see unemployment creep up quickly.”

More than a decade ago, Greene made a fortune from the wreckage of the housing market and reinvested some of his profits into apartments and condominiums, eventually building a residential real estate empire concentrated in south Florida and Los Angeles. But despite skyrocketing prices for real estate across the country, Greene thinks the boom will soon turn to bust. “The real estate market is in a bubble,” he said. “We’re way overbuilt and you’re going to see a lot of people have problems with their real estate developments,” he posited, referring to residential real estate.

He also sees a parallel between the subprime mortgage crisis of 2007 and the booming stock market and crypto wave of 2021. “It's like when I was doing the subprime short [betting that the value of subprime mortgages would fall] and I remember saying, 'Who's on the other side of this trade?' These mortgage-backed securities had almost no possibility of being paid back,” he said.

"It's the same thing with people saying, 'Well I have to buy equities because I don't want to make one percent [return with low interest rates] so I'm going to put my money in something that's highly inflated,” Greene said. “And they bought crypto, SPAC shares, houses to flip, equities and private equity investments at unprecedented multiples of revenue with no prospect of earnings whatsoever.”

While he still invests in a range of stocks and private equity, he told Forbes he’s now more risk averse than he was a decade ago, with little debt on his real estate projects in Florida and New York, where he recently finished construction on a 30-story residential building in lower Manhattan. He’s also turned down several offers to sell his buildings for cash or invest in highly-valued private companies in early funding rounds. (He won’t say which particular companies have approached him.)

Unlike his successful bets against the housing market in the Great Recession, Greene isn’t shorting anything this time around. Asked what he would do if he was more open to taking risks, he outlined a potential strategy. "If I were more aggressive, because I saw this [bubble] happening, I would have sold more at the top. I would have built a war chest and been sitting here waiting for opportunities [to buy at lower values],” Greene said. “The kinds of deals that people were bringing to me to invest in some of these tech companies, I was getting calls [saying] ‘I can get you into this special round at a billion dollars, the company is doing $40 million in sales.’”

He found those offers to be overpriced: Greene thinks many of those tech companies are bound to run into difficulties as the stock market continues to drop and the economy enters a recession next year. "[I’m] thinking, 'Who's doing this?'” he said, referring to investing in startups at sky-high valuations.

“I have friends who are very smart people that were doing this and everybody thought they were going to be the next Zoom. A lot of these companies lose money and now they’re cutting expenses and trying to make it through this period,” he said. “You can be sure that there are companies that are going to be up against the wall. You'll be able to get into some of these—what I call 'science projects' [because] they're just sort of ideas that are unlikely to become huge—at very favorable terms. And people will make a lot of money, one of them will be the next Google or Amazon. In those spaces, there’ll be opportunities.”

Still there is no doubt that Greene is a beneficiary of the bubble. Greene, who’s lived in Palm Beach since 2009, pointed out the increasing exodus of billionaires and wealthy investors leaving northern states to relocate to south Florida, where property prices have soared since 2020. And it’s not just billionaires who are moving to the Sunshine State: rents in Miami rose nearly 26% on a year-on-year basis in the second quarter of 2022—higher than all major U.S. metro areas—and demand for apartments is near record levels, according to Marcus & Millichap.

“There's just extraordinary migration to our area, which has put tremendous pressure on [real estate] values,” said Greene, who cited the recent announcement that billionaire Ken Griffin plans to move his hedge fund Citadel from Chicago to Miami as providing yet another boost to the local economy.

The influx of the superrich to Palm Beach has also increased enrollment at the Greene School, a nonprofit pre-K-through-high school in Palm Beach that Greene founded with his wife, Mei Sze, in 2016. There are now 150 students enrolled at the school, up from 123 in the 2019-2020 school year.

"The kinds of families who are moving into our town and putting their kids in our school, it’s like the all-star team,” he said, citing a pre-K class with parents including several Ivy League-educated hedge fund founders. “These are people that will create all kinds of jobs and businesses that are going to juice the Palm Beach county economy. I'm very bullish long-term on the economic growth and the value of my holdings there.”

Greene estimates that he owns “virtually all of the remaining high-rise development sites on the water” in Palm Beach, much of which he acquired after the housing market crash in 2009 when land values were cheap. But even if the property market in south Florida is still booming, Greene sees dark clouds ahead if, as he expects, the economy tips into a recession in early 2023—particularly for real estate investors who are highly leveraged.

Even among fellow billionaires, Greene has seen the impact of recession fears on their high-spending lifestyles. “I was at Hotel du Cap with a bunch of superrich people [two weeks ago], one of the most expensive hotels in the world in Antibes, France, and everybody’s saying ‘Oh my god, I’ve lost 30% of my net worth.’ But they’d already booked the hotel,” he said. "Those days are going to be over this winter. You’re going to start seeing people spending less money and the recession will kick in.”